If sustainable finance doesn't contribute to saving the world, should it be saved?

By Carole

Driven by a thirst for learning and a desire to contribute to a better world, I have dedicated 20 years of my professional life to sustainable finance. After all these years, it became necessary to confront this fundamental question: why, despite the rise of sustainable investments, have the trajectories of environmental destruction, increasing inequalities, and climate change not budged an inch?

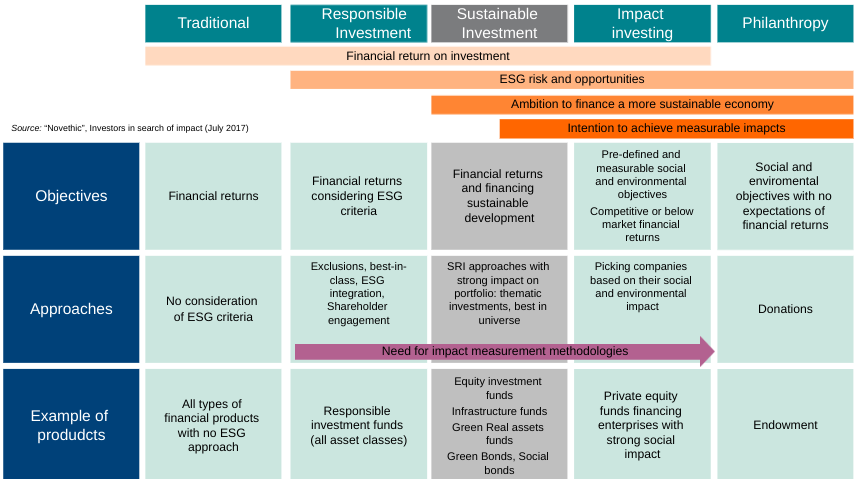

What exactly is sustainable investment?1

This generic term refers to any investment that takes into account environmental, social, and governance (ESG) issues. To better differentiate between different types of sustainable investments, we need to first understand the objectives of sustainable investors.

These investors can have 1, 2, or 3 objectives.

💶 The first objective, shared by the vast majority - and often the only one - is to maximize its risk-adjusted financial returns, especially through a better understanding of ESG issues that can be either favorable or unfavorable to the issuers of investment vehicles (e.g., company stocks).

This can mean investing in technologies promising to improve energy efficiency because there is an expectation that the demand for such solutions will increase, or divesting from coal producers because there is an expectation that regulators will require power plants to close to meet climate goals.

⚖️ The second objective is not to contribute to financing or even holding securities related to activities deemed incompatible with one's values: for example, excluding weapons, tobacco, or coal, but this time for ethical rather than financial reasons.

🌍 The third objective, finally, is that holding these investments, and maintaining a dialogue with issuers (ultimately sanctioned by shareholder votes at general meetings), leads to a net positive social and/or environmental impact. In other words, these investments should have a positive contribution in the real world, and this contribution should be as intentional, measurable, and additional as possible (i.e., the positive impact would not have occurred without this investment).

Why can you find the oil producer"TotalEnergies" stocks in labeled sustainable funds?

💼 From the perspective of the sole objective of profitability, investors wishing to limit risk may decide to keep TotalEnergies in their portfolio because the company, compared to its peers in the sector, has the best ESG ratings. This is the "best-in-class" logic: even in a class of underachievers, some students are better rated than others, and they are chosen to minimize risk.

🙈 The second objective of value alignment would require that investors who have committed to carbon neutrality by 2050 and who exclude coal companies shall also exclude oil companies like TotalEnergies that continue to expand their production, as this is incompatible with their commitments2.

However, arguing for the third objective of a positive real-world contribution, many choose to remain invested in the company, claiming that dialogue and voting at general meetings will push TotalEnergies to transform itself to align with the Paris Agreement and eventually stop exploration (third objective).

Can it be proven that engagement with "brown" companies has a positive impact?

💶 According to Kölbel et al.'s meta-analysis on the subject3, shareholder requests on ESG issues have between an 18% and 60% chance of success, and success is negatively correlated with the cost of implementing the measure.

🎈 Over the past three years, we have observed a considerable increase in shareholder resolutions on ESG issues at general meetings, but at the same time, the support of major shareholders for these resolutions has decreased4. This can be attributed to various factors, including a stark gap (aggravated by the energy crisis related to Ukraine) between the share price trajectories of highly carbon-intensive companies (driven by profit maximization) and the achievement of sustainable goals that would require profound changes in business models. As a result, more and more investors focus on requests for extra-financial reporting rather than on the implementation of plans to align with the Paris Agreement.

🙊 The case of TotalEnergies illustrates the fundamental dilemma for investors between short-term profits and decarbonization pathways. At the 2022 AGM, only 7% of shareholders voted against share buyback measures that allowed them to receive a significant portion of the company's windfall profits.

Yet in 2023, more than 30% of them demanded that the company set emission reduction targets compatible with the Paris Agreement. But how can the company be pushed to invest in transition if its profits are largely distributed to shareholders5?

Okay, but there are fossil-free funds or funds that only invest in companies offering solutions. Does divestment or investment make a difference in the real world?

📚 Meta-analyses on the subject of exclusion6 show that divestment from the secondary market (already-circulating securities) has no impact on a company's ESG performance. However, discontinuing financing (especially through debt) can be decisive for the company's cost in seeking other financing and ultimately challenge less profitable projects.

However, bank lending policies are still mostly lenient toward fossil fuel financing, including coal6, with only 28 out of 437 banks analyzed having a robust coal divestment policy.

🚨 Regulation prohibiting industrial players from new fossil fuel developments incompatible with their commitments would be much more effective than convincing all stakeholders to stop financing perfectly legal activities.

Minority sustainable finance won’t change anything as long as non-sustainable finance assets remain prevalent and as the current approach focuses more on relatively virtuous behaviors (“relative sustainability”) than on those truly compatible with planetary limits (“absolute sustainability”).

💧 On a larger scale, we see a similar phenomenon to that of energy sources: if it involves additional financing that does not challenge other majority financing, it will only stack up without changing dominant trajectories.

Can the goal of better financial performance be achieved at least?

📈 Sustainable finance professionals have consciously or unconsciously perpetuated the belief that one could easily "do good by doing well". Obsessed with the idea of transforming risk into opportunity, managers have rushed into a self-fulfilling prophecy: investing in companies with the best social and environmental practices will be profitable because the world will change, the rules of the game will evolve, and constraints will multiply, causing the stock prices of these companies to rise due to this positive anticipation.

However, this involved a significant initial assumption: that behaviors, and especially laws, would change, and that the commitments made by states to achieve carbon neutrality would be followed by concrete actions such as carbon taxation and massive investments.

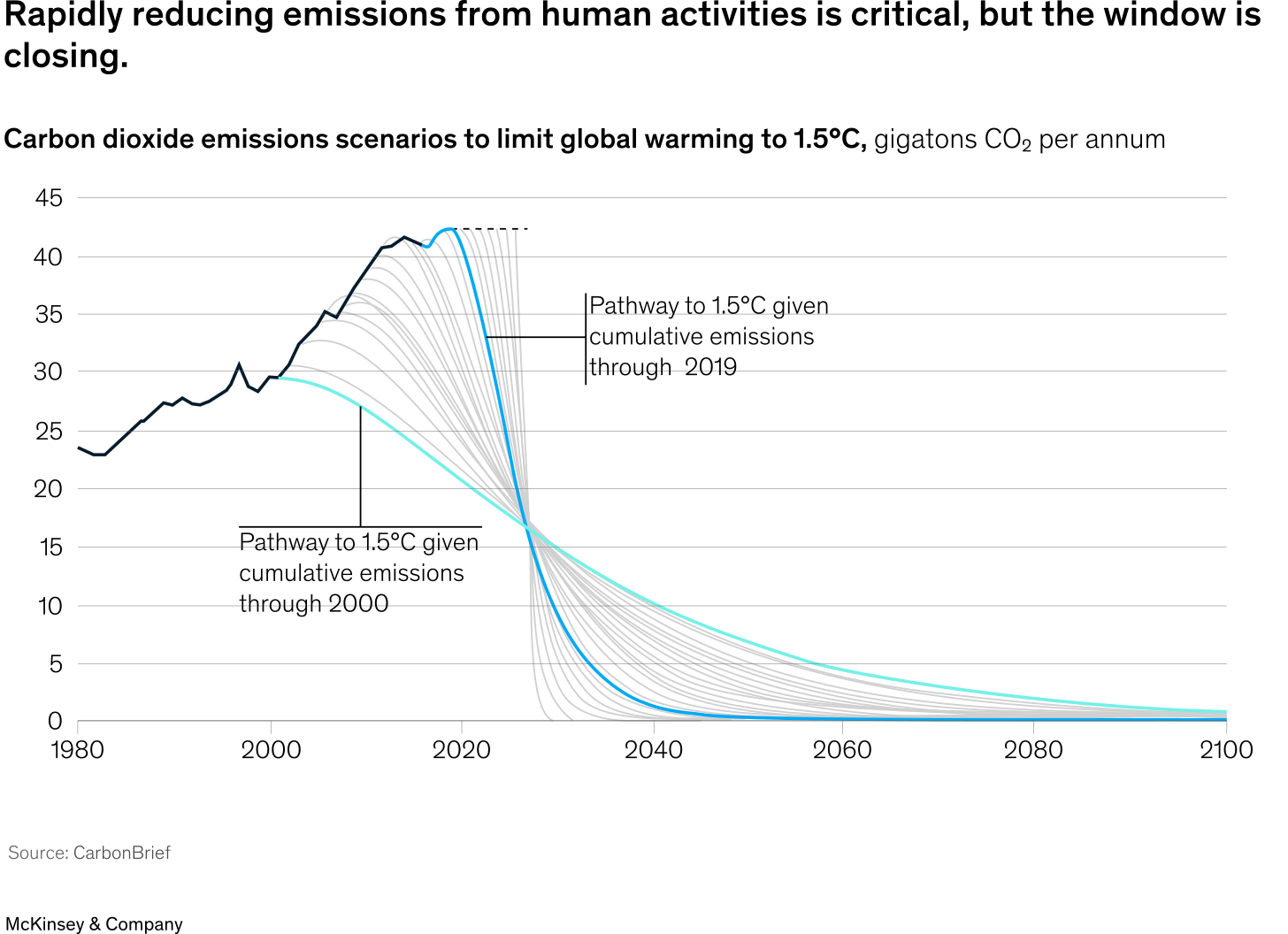

We should have known better: since Kyoto, NONE of the commitments has ever been fulfilled. Investors fell victim to a misreading: if plans become more ambitious at each COP, it's not because "things are changing," it's because action has been increasingly delayed, requiring a more violent transition to limit warming, as shown in this illustration7:

🔥 The rapid rise of sustainable investments after the Paris Agreement was nothing but a flash in the pan, extinguished by the war in Ukraine and the sudden energy crisis of a Europe dependent on Russian fossil fuels. Despite unprecedented ambitions by states and neutrality plans announced by companies, investors eventually realized that for policymakers, short-term interests and economic continuity would take precedence over increasingly unrealistic commitments: a resurgence of coal in Germany, doubled fossil fuel subsidies to preserve purchasing power...

Investors' expectations unravelled as oil prices soared, undermining the relative financial performance of sustainable funds, which are generally somewhat less exposed to this sector.

This was, therefore, a "return to reality": the three objectives that sustainable finance claimed to pursue simultaneously became antagonistic, and we returned to the primary objective, which challenges the other two in many cases: maximizing the risk-return couple solely for the financial benefit of the investor. The incompatibility between profitability and value alignment objectives, and especially positive impact, becomes glaring in the short term. The time horizon on which financiers are evaluated is too short to allow for long-term considerations such as a potential regulatory rebound.

🔒 Despite awareness, powerful barriers prevent regulatory action: systematic lobbying, supported by the two bogeymen of purchasing power and unemployment, but also the reassuring belief that technology and sustainable finance will save us through the power of goodwill.

For my part, I am now finding other ways to quench my thirst for action and learning.

In this article, we focus on sustainable finance as a whole, rather than specifically on impact investing, which represents only a fraction of sustainable funds (less than 5%).

As stated by the International Energy Agency as early as 2021, any new fossil extraction capacity (coal, oil, and also gas) is incompatible with a warming target of less than 1.5°C. https://www.weforum.org/agenda/2022/10/fossil-fuels-incompatible-1-5c-goal-energy-climate-change-study/

Kölbel, Julian F., Florian Heeb, Falko Paetzold, and Timo Busch. in press. ‘Can Sustainable Investing Save the World? Reviewing the Mechanisms of Investor Impact’. Organization & Environment.

According to the Morningstar study published in July 2023, votes in favor of climate shareholder resolutions have decreased by 15% compared to 2022, and investors prefer to support resolutions related to the disclosure of reporting and strategy rather than those explicitly demanding results.

https://www.irmagazine.com/esg/support-continues-fall-climate-focused-resolutions-finds-morningstar

(about 5% of the company’s market capital during the year 2022)

Berk, Jonathan B. and van Binsbergen, Jules H., The Impact of Impact Investing (August 21, 2021). Stanford University Graduate School of Business Research Paper , Law & Economics Center at George Mason University Scalia Law School Research Paper Series No. 22-008

Systemic change, which is required for a just transition to a low-carbon economy, requires demoting profits from their position as the overriding goal of investors. That awareness has not even begun to set in.